After serving in England, I had a newfound taste for travel. Jordan and I were young, married, and attending school full time, but every dollar extra we earned in our random school jobs we put into savings. What started as one big fund was eventually split into multiple categories allowing us to really be intentional with our savings. By purposefully focusing on saving for travel, we eventually were able to save enough to go back to England and visit some of my many loved ones there. These savings didn’t happen overnight. Jord and I saved for almost 5 years to earn enough for what I considered our “trip of a lifetime”.

When we first started saving, I could have never imagined that life would be so different as we grew older and the budgeting and savings that we started early on would make such an impact now. Budgeting when we really had no money, helped us to recognize how important saving for travel is to us. What I had originally considered the “trip of a lifetime” turned into one of many trips. We have never had to go into debt or be anything less than self-sufficient to travel. It is something we recognize as a huge blessing.

This understanding, that Jordan and I have been greatly blessed with enough, is the reason I decided to start sharing what I have learned through this medium. Budgeting and saving, being a big lesson for us, may be featured a lot in the coming months. I plan on sharing more on how we divide our income into a budget soon. This post, however, is focused on how we budget and save for travel.

Two types of savings

When thinking of budgeting and saving for travel, I think the first thought is always budgeting for specific travel. Specific travel is something you either have already planned or are starting to plan, that is in the near future. However, there is another type of travel savings that I think is often missed, which is general travel. A general travel fund is something to build over time, even if you have no specific travel plans yet. Both types of travel savings have their purposes and accounting for them in your budget is crucial if you strive to travel more.

Specific travel

Obviously, if you have a vacation coming up or are wanting to go on holiday, you ought to be saving for it. As previously shared, I always plan my vacations and use my travel planner to do so. I love it so much that I shared how I use my travel planner and how to receive your own travel planner copy for free on my post, How to Plan a Vacation without Stress. One of my favorite parts of my travel planner is budgeting for my anticipated expenses for that specific trip. When saving for travel I take that projected expense total, calculate how many months I have until the desired holiday, and then break down the cost backwards.

Let me give you an example. Let’s say we want to go to Thailand in December and estimate that it will cost us six grand to go, with rounding up and adding a little for some wiggle room. I would then divide the six grand by the number of months leading up to December from now (8), which equals $750. The goal is to save that much each month towards our trip.

This is especially helpful when attempting to see if a trip is possible. If I can’t make $750 (from the example above) work in our budget, then we can’t go on the trip. Now, let’s say we already have three grand saved. Then we would subtract the savings of 3k from the estimate of 6k and divide the remainder by the months in between (8). That equals $375 per month, which may be more doable. We could then justify sacrificing in other ways (which we will get into later) to save for this trip and actually be able to go. Sweet, sooo how do you get the three grand? Well, you start saving for general travel well before.

General travel

General travel funds are there to help you prepare for those rainy days or spontaneous travel opportunities that life gives you. Jordan and I have an ongoing general travel savings fund that we put money into throughout the year. Depending on if we have specific travel plans, among other life situations, determines how much we are able to ascribe to this fund monthly. If we have specific travel plans, we follow the example I gave previously to determine how much we need to save monthly. We try to save so that we can travel internationally every other year. You can do this too!

Ideally, you are already budgeting and adding a travel fund will just be adding a row in your budget sheet. You then save what you can feasibly, and add that to your fund. You may need to just start with a general travel fund to grow that savings muscle. Unfortunately, there are no quick fixes when it comes to money, and true savings requires a commitment to just start and let that savings be until you have enough to really see the benefit.

Ways to Budget/Save

There are so many ways to budget & save for travel, but, ultimately, you have to decide what is right for you. Saving for travel is really only impactful if you are committed. Here are some ways to budget for travel:

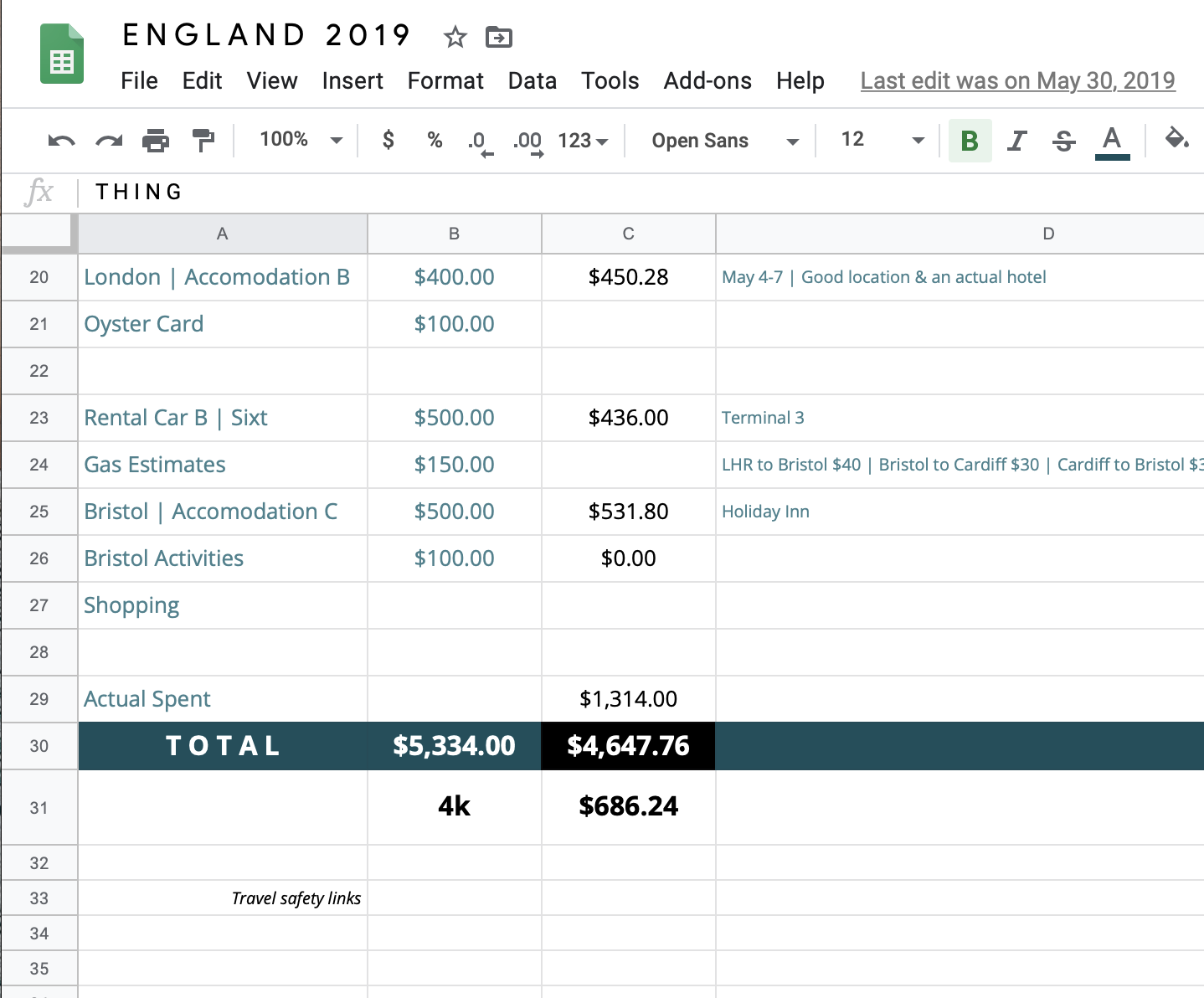

An example of how we save for both general and specific travel, plus other fun savings. It is clear travel is a priority for us.

Utilise a Separate Travel Fund

When we first started saving for travel, I literally would put the extra $5 (or something like that) in an envelope and hide it in our house somewhere. Don’t do that. 😂

There are much better ways to have your money “out of sight, out of mind” then to hide it in your home. My complete-non-professional advice would be to open a high yield savings account, this way you can start to earn interest on the money you are saving. A huge help is to put your money into your savings the day you get paid, like ASAP. This will help with “the out of sight, out of mind” philosophy. Jordan and I do this when we get paid. We first take out the money that we donate to our church (tithing), pay any bills (like rent, etc), and then put money into our savings based on our planned budget.

Wants vs. needs

The number one thing to do to save in general or for travel is to track your spending through budgeting. Through budgeting, you will be able to assess what you spend a month on your wants vs your needs. Needs are things that you need to live your life like rent, utilities, groceries. Wants are things like subscription services (Netflix, etc), dining out, or even a gym membership. It is up to you to determine what is a true need or a want, and then the goal is to find ways to save through cutting back on your wants.

Cutting back

Probably the hardest step is finding the desire to budget and reevaluate what you are spending money on and what is important to you. Once you are ready to have that real look, it becomes easier. Clarity on where you are now and what you want makes cutting back easier. Sometimes you decided to not just cut back but to cut out. Everyone will have their own unique budget as to what they really want to save for and spend their money on–you just need to find what works for you! Here are some ways Jord and I have cut back and still enjoy our present moments:

Subscriptions

This was the most obvious to us because it was a monthly cost. I feel like you never sign up for a new subscription thinking you will use it forever, but then life happens and you never really unsubscribe. I don’t have that issue when it comes to like beauty boxes and those types of things, but when it comes to media services, I struggle.

It was just a few weeks ago that I decided to give up television for a week, which to me was all subscription services, to try to help myself focus better. It worked. It was one of the most productive weeks I have had in a while. After breaking my tele fast, I decided it was time to reevaluate what subscriptions I bought into. Jordan and I discussed which of these services we felt were uplifting to us and then we reduced. Some subscriptions are annual, so we either canceled or put a reminder on the calendar to cancel before it renews. Ultimately, we can always resubscribe if we feel we can’t live without it. There is no need for us to fall victim to FOMO when it comes to television.

Convenience

Cutting back on convenient things is so difficult. This is a super hard one that, to be honest, we still aren’t the best at cutting it out. Convenience is buying lunch instead of bringing your own lunch, buying a book instead of renting one from the library and like-things. For us, food is definitely the convenient item that we waste more money on then we should. We try to combat that by meal prepping some basic lunches for the week. Dinners can be rough depending on the day we had but we still put forth the effort to cut back on convenient dining. It helps to remind ourselves why we are saving, and then either eat at home or go for a cheaper meal.

Facebook is a great place to look up free events and activities near you!

Activities

Intentionality is massive in savings and this is especially seen in the activities you choose to do. A simple change is to go to lunch over dinner with friends because lunch tends to be cheaper. It is choosing a cheaper place to eat out, or getting hot cocoa with someone versus a meal, etc. Plus, there are so many free things you can do in your city or town. I know that Salt Lake has free movies in the park in the summer, a monthly free night at the zoo during the fall, and so much more. With a little effort, you can save loads on activities by opting for the cheaper or free event over the paid activity.

Utilities

This may not be relevant to all but, for us, is something we can impact. Utilities can vary from electricity to your mobile plan. Jord and I try to be conscientious of our electricity and gas usage, by keeping our thermostat closer to the outside temperature and turning off unnecessary lights, etc. We also chose our phone and internet plans carefully to try and reduce costs. Also, when our internet bill suddenly raised at the end of a year, I called our service to see if I could get a better deal. They were able to keep our prices the same and actually deliver better internet speeds. I never knew that services did that to keep your business. Just shows you gotta shoot your shot, because you never know what will happen.

You know your situation best and through some trial and error figure out how to best cut back and save for your next holiday.

You got this!

As you start to save you will quickly see a snowball effect. Put up some images around your home that remind you of why you are saving, watch your fund grow, and enjoy your cut back lifestyle. Then when you do go on vacation, enjoy every moment knowing you paid for it yourself! You got this! I can’t wait to hear all about your travels. Leave me a comment if I missed one of your favorite saving for travel techniques!

Related content: How to Find Cheap Airfare, A Complete Guide to Google Flights, How to Plan a Vacation without Stress

Pin this for later: